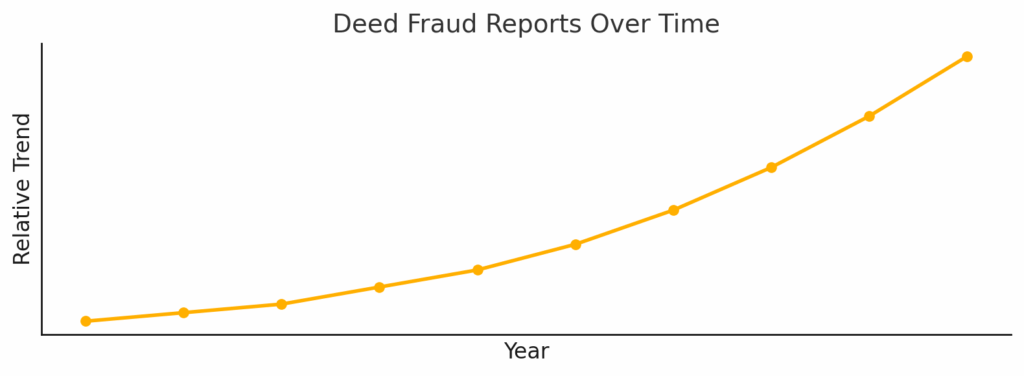

Deed fraud is no longer rare — it’s rising rapidly and becoming more sophisticated. From forged signatures and fictitious mortgage documents to stolen identities and fraudulent transfers, these schemes are quietly disrupting lives and complicating real estate transactions across the country.

The consequences are wide-ranging: properties tied up in legal disputes, families caught off guard, closings derailed, and in the worst cases, homes stolen through title theft — often without the true owner knowing until it’s too late.

Real Cases, Real Risks

This isn’t a future threat — it’s happening now:

- Dunedin, FL (2023): A man discovered his house had been stolen through a series of forged mortgage documents and fraudulent deed filings. The property had been transferred multiple times to fictitious entities. YouTube

- New York City (2022): A criminal ring targeted elderly homeowners, illegally transferring their properties by forging deeds, leaving some residents homeless and financially devastated. ABC7 New York

- Houston, TX (2022): A local jury returned a guilty verdict in a deed fraud scheme where fake documents were used to unlawfully claim and sell real estate. Federal Housing Finance Agency

Each case started with the same vulnerability: unclear ownership, deceased owners and outdated records.

How It Happens: The Quiet Danger of Tangled Titles

Fraud like this doesn’t require breaking in — it only takes a gap in the paperwork.

That gap often comes from what’s called a tangled title — when a property is still in a deceased relative’s name, or when multiple heirs haven’t legally transferred ownership. Properties like these often sit unnoticed by the legal system, making them prime targets for bad actors who know how to exploit silence, confusion, and delay.

And the deeper risk? Most people don’t even realize there’s a problem until it’s too late.

Why It Matters

Deed fraud is a symptom of something deeper: unclear ownership, outdated records, and a lack of oversight.

This isn’t just a legal issue — it’s a clarity issue. And clarity is what keeps homes protected, closings on track, and families in control of what they’ve inherited or invested in.

Whether you’re a family member sorting through an estate, a title company trying to clear a file, or an investor dealing with dormant properties — confirming rightful ownership is essential protection.

This is the work that prevents fraud before it begins. And it’s one of the reasons Seek Research exists.